A house equity line of credit could be the most effective remedy for you if you prepare for having numerous stages of your rewiring job or you aren't sure of the complete price in advance. A HELOC functions like a bank card in that you'll obtain accessibility to a line of credit with a limitation that's a percent of your residence equity and also you can borrow from it numerous times. A HELOC uses your house as collateral, which implies the rate of interest are commonly lower than credit cards or individual finances, and also as you settle what you borrow it liberates much more available debt for reuse. Some states may need you to pull a permit before any type of work can be carried out. You can be fined if you do not get a permit for a task that calls for one, so understanding whether this is required can save you from having to pay punitary expenses after the fact.

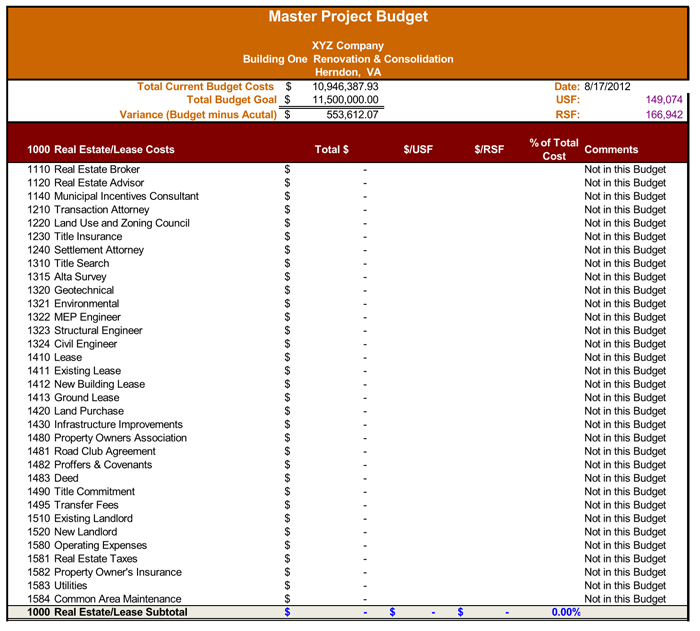

Constructed Properties-- All straight prices associated with the construction job shall be included in developing the asset assessment. Acquired Assets-- The recording of bought assets will be made on the basis of actual costs, including all secondary expenses, based on supplier invoice or other supporting paperwork. Words "restoration" and "renovate" are frequently utilized reciprocally, but if you're planning some significant residence improvements, it's best to get the terms right before you speak with a specialist. While both remodelling and remodel will certainly enhance as well as update your space, both types of tasks are very different, each with its very own collection of advantages and considerations. Learn more about 6 essential differences that will assist you keep the lingo straight-- restoration vs. remodel-- and also nail down the job that best suits your house.

Where Should You Start First When Renovating A Home?

How do you pay for home renovations?

Best ways to finance home improvements 1. Personal loans. Getting a personal loan is a great option for mid-size projects on your home, such as a bathroom makeover or window replacements.

2. Home equity line of credit (HELOC)

3. Home equity loan.

4. Refinance your mortgage.

5. Credit cards.

6. Government loans.

Zero-interest fundings are better, yet getting qualified can be rather tricky. You might invest large dollars to include a huge three-season room to the rear of your home, however if your roofing leakages and the furnace doesn't function, customers will go in other places. A significant kitchen area remodel, however, will net just around 60 percent ROI as well as adding a master suite addition to the residence will certainly bring nearly half ROI.

- Your freshly redesigned house comes to be collateral, as well as all you have to do is pay on time to avoid the threat of shedding your property.

- Since renovating might entail changing the physical structure of a residence, it's often necessary to reconfigure the circuitry, pipes, and ductwork, which makes the job extra intricate and also expensive.

- You could invest big dollars to include a large three-season room to the rear of your home, however if your roofing leaks and the heating system does not work, purchasers will go in other places.

- Zero-interest lendings are better, but getting qualified can be rather complicated.

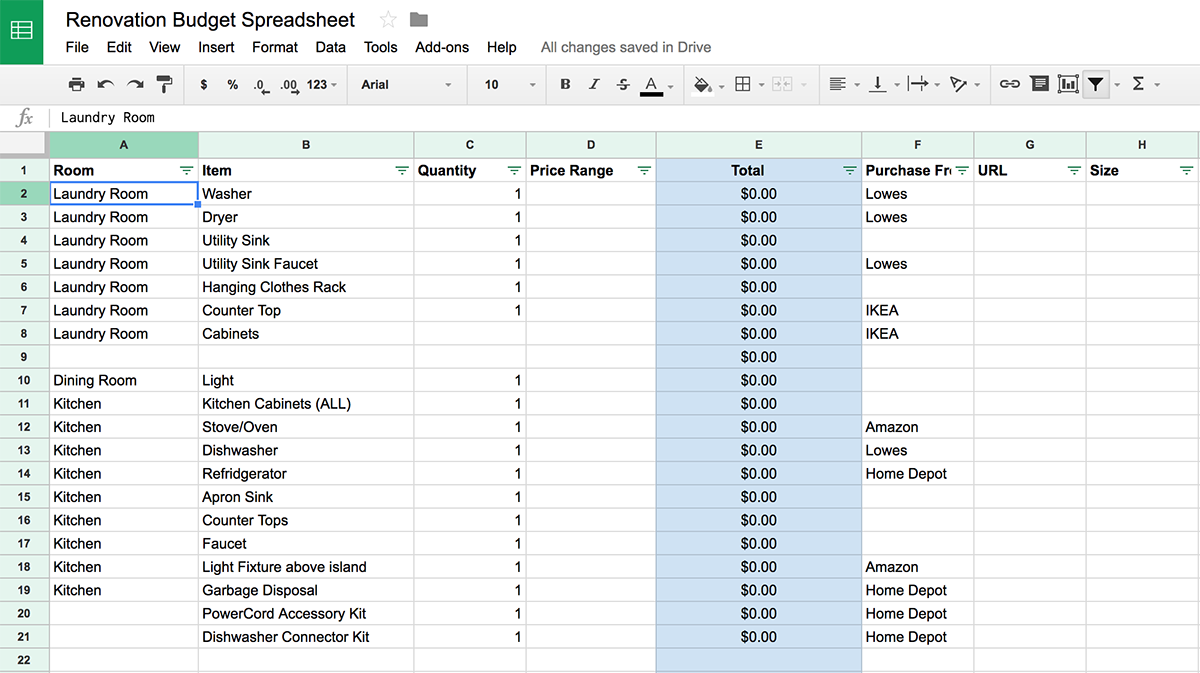

What should I remodel first?

If you need to choose which room to remodel first, you'll want to choose the room that will recoup the remodeling costs and create actual equity. This is why experts agree that choosing to remodel your kitchen or bathroom first is traditionally the smartest move.

Generally, house owners are investing much more on remodeling tasks than they have because the economic downturn. Home enhancement spending in 2017 got to almost $425 billion, or half more than it was in the https://regencyhomeremodeling.com/kitchen-remodel-northbrook-il/ post-recession results in 2010. If you're considering refinancing, think about the drawbacks carefully.

With 40 percent of the 137 million residences in the country a minimum of half a century old, remodeling projects are most likely to bring in investment returns. Generally, house owners are picking to place their cash toward replacement tasks. Outside and also indoor replacements as well as systems and also equipment upgrades are up virtually 10 percent because the economic crisis. The bottom fifty percent of the top 10 includes outside projects and additional systems.

Is it better to remodel or move?

Whether or not it's cheaper to renovate or sell depends on your current mortgage situation, as well as how much money you have in savings. Renovations come with immediate, out-of-pocket expenses, whereas moving can put money in your pocket now but cost you a lot more down the line.